Why Every Business Owner Should Have An Infinite Bank

As a business owner who implements the Infinite Banking Concept, I can confidently say that IBC is one of the most powerful financial strategies in the world that most people have never heard of or don’t understand.

But when I was speaking to a friend of mine in the commercial financing industry the other day, and he shared with me how much business owners were struggling, and how it was becoming much more difficult to acquire the working capital and financing that businesses need to operate, I realized how important Infinite Banking is for business owners.

Why?

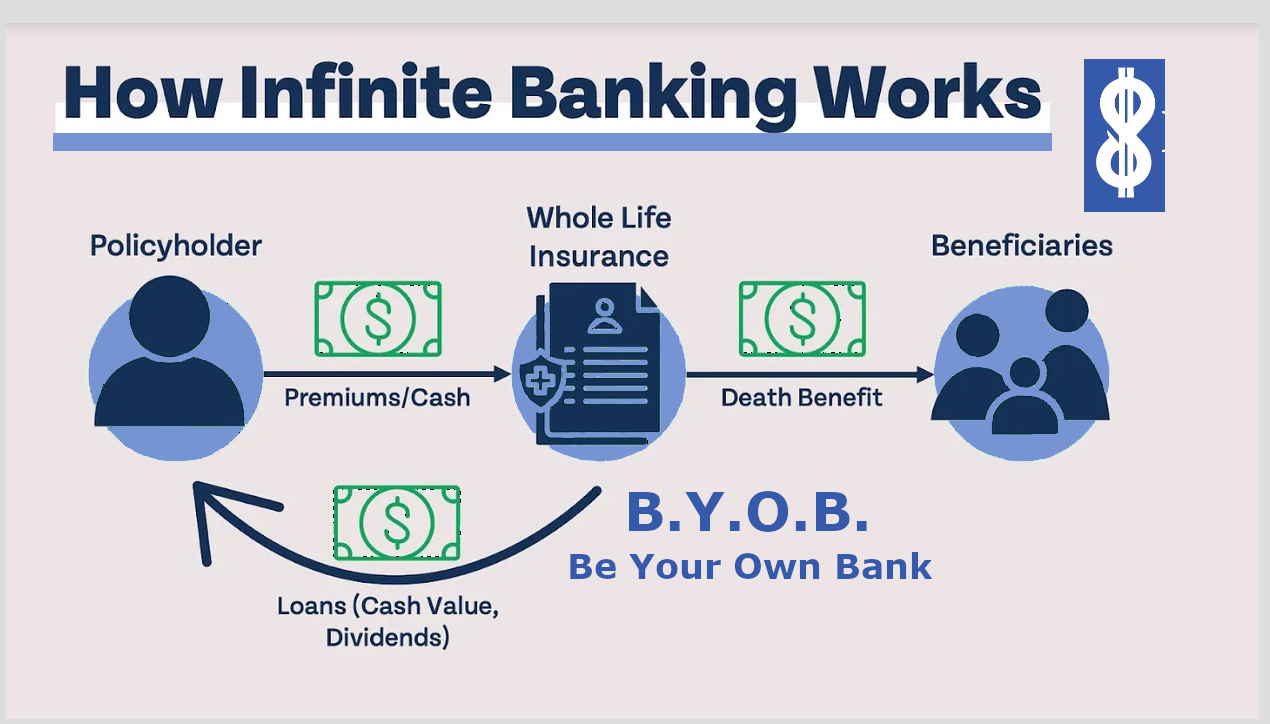

Because implementing the Infinite Banking Concept with a custom designed dividend-paying whole life insurance policy allows us as business owners to create our own private banking system that will always provide the capital we need to run our business, regardless of market or economic conditions.

With our own private banking system, we don’t have to apply or get approved for the capital we need.

❌ There are no applications.

❌ No credit checks.

❌ No tax returns.

❌ No bank statements.

❌ No personal guarantees.

❌ No denials.

❌ No approval process.

We simply tell the life insurance company how much money we need based on our cash value, and the money is in our account within 2–3 business days, no questions asked.

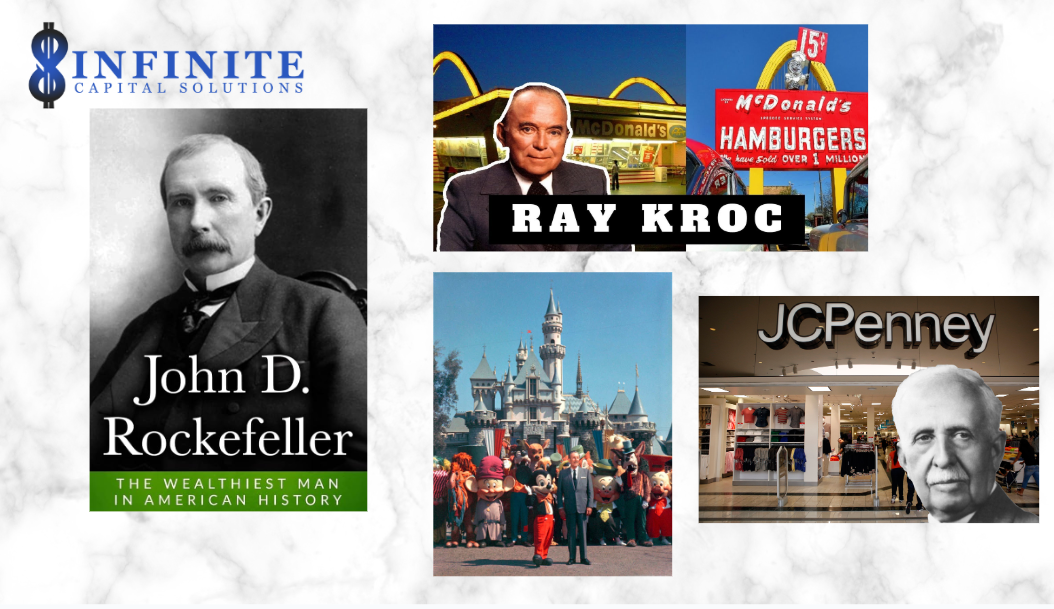

IBC IS NOT NEW!

It’s been in use for generations of the wealthy using it to fund their business.

Ray Kroc used it to fund the purchase of McDonalds.

Macy’s used it to save his stores from the Great Depression.

Walt Disney used it to fund DisneyWorld.

But while the access to working capital without restrictions is a very big benefit of these policies for business owners, this isn’t where the story ends.

In addition to setting up our own private banking system that never says no to our request for capital, the money we put into our private banking system to fund it, provides us incredible additional benefits that traditional financing and bank accounts don’t come close to providing us.

#1: Competitive Interest Rates

The loans we take against our policies can often provide far more competitive interests rates than other forms of financing, especially when the Fed raises interest rates.

My current policy loan rate is only 5.5%.

That’s not too bad right now!

Plus, policy loans are unstructured. Meaning there are no loan repayment requirements.

WE decide how much we pay back and when.

So, if cashflow is tight one month, we can skip a payment without a lender harassing us, impacting our credit, or the threat of losing any collateral.

#2: Uninterrupted Compound Growth

When you set up an Infinite Banking policy, and then borrow against it to fund your business needs, because you’re borrowing the life insurance company’s money, your money (the cash value) continues to earn the typical 3–5% tax-free compound growth that these types of policies usually deliver.

This means, that while you use the money within your private banking system to grow and operate your business, it continues to grow uninterrupted.

This is an incredibly powerful way to build wealth in two different places at once, and the only cost to do so is the simple interest charged on the policy loan.

#3: Return of Principal

When you make a payment to a traditional lender, what happens to the money you pay them?

It’s gone forever, never able to be used to earn more money for YOU ever again.

(Unless you’re using a line of credit, but we’ll cover the disadvantages of those in a minute).

That’s called “Lost Opportunity Cost” and it adds up to hundreds of thousands, sometimes millions of dollars out of your pocket over your lifetime.

What if every time you made a payment on your loan, the principal was restored in your banking system, available to be used yet again for whatever you need?

This is one of the incredible parts of an Infinite Banking policy.

Every payment you make towards your policy loan immediately becomes available again to borrow against (similar to a line of credit, but without all the other benefits of these policies).

If you called up your lender and told them you need all the money you’ve repaid them over the last 6 months for a new business opportunity, what do you think they would say?

They’d think you’re crazy and tell you to just apply for a new loan.

With an IBC policy, the cash value you’ve restored with every payment is instantly available to borrow again, no questions asked, AND IT NEVER STOPPED EARNING INTEREST THE WHOLE TIME!

Do traditional financing options do that? Nope.

Does your line of credit earn you uninterrupted compound growth? Nope.

#4: Control of Capital

Banks can change lending requirements and make it more difficult to get the funding we need at any time, for any reason, no matter how good our business is doing.

They can call loans due if economic conditions get too bad, they can reduce or straight up eliminate lines of credit, and pull a dozen other strings that we have no control of, yet can have a massive impact on our business.

This should be very concerning to any business owner that relies on capital and funding to operate their business.

If that capital and funding was suddenly cut off, what would you do?

Maybe you’d figure it out, maybe you wouldn’t.

The real question is, why put yourself in that position in the first place?

Why expose yourself to that level of risk if there is a better alternative?

Now I’m not saying to never utilize traditional financing and lines of credit ever again.

I’m saying that the risk of controlling access to capital needs to be addressed if it’s something you rely on to run your business.

And a custom designed Infinite Banking policy set up for high cash value can significantly reduce this risk because there are no restrictions to your access to the cash value in your policy.

#5: Institutional Safety

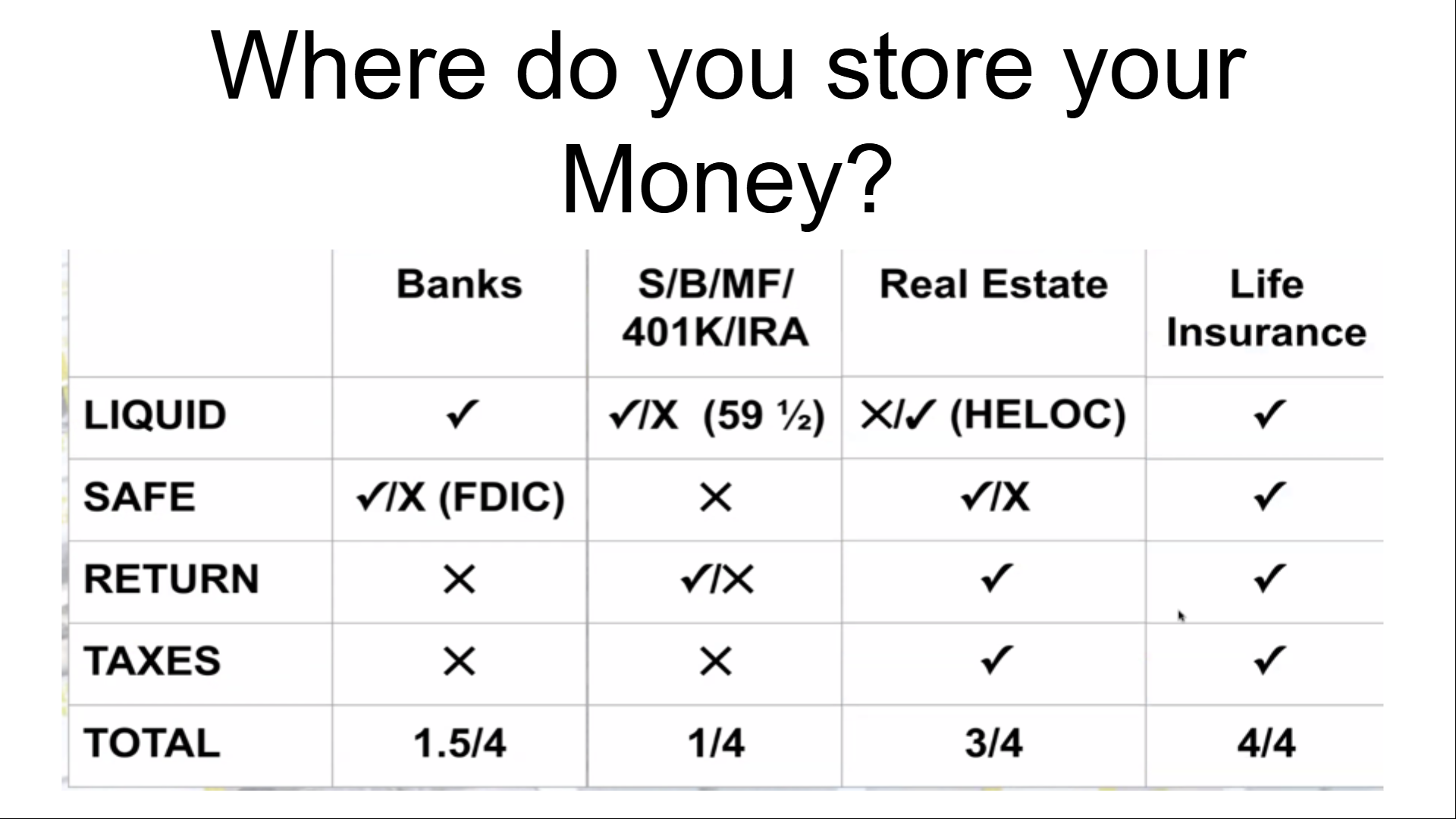

Most people assume the safest place to store and save our hard-earned money is in banks.

I thought this for a long time just like everyone else.

But when you study the history of banks, they don’t have a good resume or track record of being a safe place to store money.

Tens of thousands of banks have failed over the last 100+ years, costing unsuspecting depositors billions of dollars.

During the same time frame, the mutually owned life insurance companies that we set up these Infinite Banking policies with have never missed a dividend payment to their policyholders.

While thousands of banks failed during the Great Depression, the Savings and Loan Crisis, and the 2008 GFC, these life insurance companies were still profitable and paid out dividends to their policyholders.

Why?

Because they are the best risk management and financially sound companies on the planet, and are also no exposed to the risk of fractional reserve banking.

They literally run circles arounds banks when it comes to safety.

So, what would you do, if tomorrow when you wake up, the bank you have your money saved in and do business with, suddenly went belly up due to insolvency?

Think the FDIC is going to bail you out?

Maybe they will, maybe they won’t.

If they do, how long would it take to get access to your money?

All things to consider.

Yet, again, the real question is, why put yourself in that position in the first place if there is a better alternative?

If there was a FAR better, safer, and more efficient place to store and save your hard-earned capital, would you want to know about it?

If the answer is yes, then Infinite Banking is definitely something worth exploring.

I’ve covered a number of different reasons why Infinite Banking policies can be extremely beneficial to business owners.

However, there is still a lot more to learn about how the Infinite Banking Concept works before you can decide whether it makes sense for your business or not.

That’s why I put together a FREE Infinite Banking Masterclass to help you learn more about how this incredibly powerful financial strategy works and how I’m using it in my own life and business to accelerate my ability to build and protect wealth.

Either way, I hope this helped open your eyes to a different way of storing and accessing capital.